Debt financing is the one which everyone will be looking into and the question is how easily we can do that. And nowadays there are plenty of ways by which you can easily make money online and off course each one has its own risk reward ratio. If you need a very good profit there would be high risk also and you should be knowing how to manage that risk efficiently and effectively.

And yes there are ways like advertising where you risk is low but you have to put a heavy effort on marketing in this case.

To have a good financial credit history, credit rating or credit score always is a nice thing to have so that you can pay you debts off and have a good financial stability.

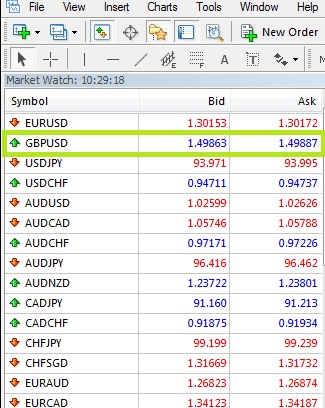

One of the popular method is forex trading or currency trading

Forex trading has become one of the beneficial way by which you can make some good profit in Dollars online, provided that you do it carefully by managing the risk that suites your appetite. You can develop your own forex trading strategy which will.

Currency rates keeps on fluctuating and it is mainly depend up on that country’s economy, inflation rate, interest rate, GDP ( Gross domestic profit), employment rate etc. So this is such a big market to get influences or manipulated by a person or a lobby and thus more preferred when comparing with trading in a security market or equity stock market where the stock prices are for a company or organisation’s growth or profit

This website tells and teaches you about some of the very basic and fundamentals of forex trading, forex trading tips and tactics, forex trading fundaments and few tips on technical analysis in a simplified manner. We are trying to post as many descriptive post as possible to that it would be helpful to you to do an easy Forex currency trading. So keep visiting and subscribe to our feed to have them served to you.

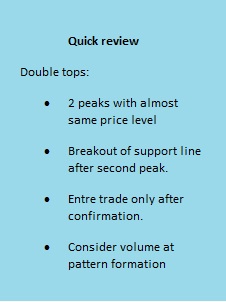

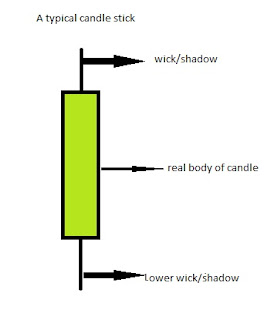

Browse through the website (the link list on the right panel) to find and learn more about different currency chart patterns and indicators.

Browse through the website (the link list on the right

panel) to find and learn more about different currency chart patterns and

indicators